Past events

Beata Hlavenková & Kristina Barta

In the DOX+ hall, SOČR will present a double concert by singer and pianist Beata Hlavenková and jazz pianist Kristina Barta. The premiere will feature new compositions as well as music inspired by poetry.

6 Premieres

Six new works by four renowned composers – Roland Dahinden, Didrik Ingvaldsen, Jan Dobiáš, and Dag Magnus Narvesen – will be performed in one night. There will be not only internationally renowned soloists, but also larger ensembles – the original and variable PMP Orchestra, the PMP Ensemble, and Dust in the Groove.

Shelter

Contemporary music performed by the BERG Orchestra – new season opening! Czech premiere of a monumental work Shelter by three composers and founders of the New York’s legendary music collective Bang on a Can.

Industrial Culture and the figure of Genesis P-Orridge

This special evening will introduce the figure of Genesise P-Orridge in more detail through a documentary screening followed by a discussion with cultural historians Nicolas Ballet and Carl Abrahamsson.

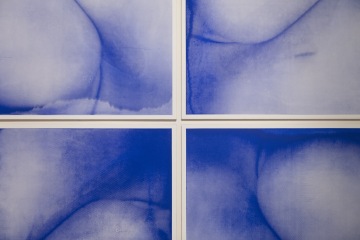

Thin Skin

A performance by established circus acrobat Eliška Brtnická and her hypnotic production Thin Skin at the interface of movement installation and contemporary circus in the spaces of the DOX Centre.

Opening: KAFKAesque

Join us for the opening of a new large-scale exhibition KAFKAesque which focused on the reflection of Franz Kafka's work and poetics in contemporary visual art.

Franck Vigroux: The Falls

A new performance by Franck Vigroux that will immerse you in a strange world between ancient myth, science fiction and fantasy. A suggestive visual show with performers and electronic music creates an extraordinary experience and an escape into a landscape that is, however, familiar to us all in its depth.

Exhibition It Is a Painful Thing to Be Alone: We Are But One with Eric Heist

In a guided tour, the curator of the exhibition Otto M. Urban, together with the artist Eric Heist, who collaborated with P-Orridge, will present the artwork of the distinctive British personality Genesis Breyer P-Orridge.

Eldar Djangirov Trio – CANCELLED

The DOX+ hall will be filled with the talented personality of contemporary jazz music, Eldar Djangirov. He will present his dynamic work for jazz trio.